For most people bookkeeping and accounting would seem like the same thing. Ask them the difference and they will be hard-pressed to come up with an answer. They aren’t to blame really, because both bookkeeping service and accounting service are actually part of the financial cycle that a company follows.

Unveiling the Vital Distinctions: Bookkeeping vs Accounting Explained

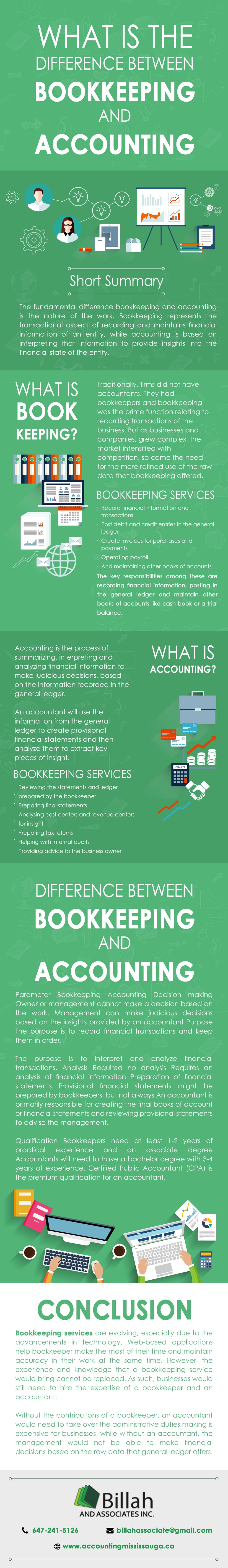

The fundamental difference bookkeeping and accounting is the nature of the work. Bookkeeping represents the transactional aspect of recording and maintains financial information of an entity, while accounting is based on interpreting that information to provide insights into the financial state of the entity.

In essence, each is incomplete without the other. Both occupy a significant role in the financial operations of a firm and help to make the best decisions for the company. Additionally, they also help to comply with the legal and regulatory requirements of filling returns, taxes and other documents with the local authority.

What is Bookkeeping?

Traditionally, firms did not have accountants. They had bookkeepers and bookkeeping was the prime function relating to recording transactions of the business. But as businesses and companies, grew complex, the market intensified with competition, so came the need for the more refined use of the raw data that bookkeeping offered.

Also Read: Why you should consider hiring Professional Bookkeeper for your Business

In a current day business, bookkeeping services are needed to:

- Record financial information and transactions

- Post debit and credit entries in the general ledger

- Create invoices for purchases and payments

- Operating payroll

- And maintaining other books of accounts

The key responsibilities among these are recording financial information, posting in the general ledger and maintain other books of accounts like cash book or a trial balance. The general ledger forms the basic bedrock of any financial statement. It helps record any transaction, expenses or sale that has been made by the company and allows the accountant or the bookkeeper (depending upon the size of the company and other factors) to prepare the individual ledgers later on when preparing the final statements.

The general ledger also helps to keep a periodical watch on the company’s financial journey and make suitable business decisions based on that information. That is why the job of a bookkeeper is as essential as that of an accountant.

What is Accounting?

Accounting is the process of summarizing, interpreting and analyzing financial information to make judicious decisions, based on the information recorded in the general ledger.

An accountant will use the information from the general ledger to create provisional financial statements and then analyze them to extract key pieces of insight.

In essence, the accountant has a more analytical job and his role is based on the work done by the bookkeeper. However, the Billah & Associates, a professional accounting firm can manage full bookkeeping responsibilities as well, but they seldom do, since they cost more than bookkeepers.

Here are some of the functions performed by an accountant:

- Reviewing the statements and ledger prepared by the bookkeeper

- Preparing final statements

- Analyzing cost centers and revenue centers for insight

- Preparing tax returns

- Helping with internal audits

- Providing advice to the business owner

In contrast to a bookkeeping service, an accountant will try to extract the key pieces of information from the financial statements. He/she will review the ledger and books of accounts prepared by the bookkeeper and make adjusting entries if required. Furthermore, the analysis will help reveal the profitability of the company, impact of cost, expected tax payments and other significant aspects of the business.

Difference Between Bookkeeping vs Accounting

| Parameter | Bookkeeping | Accounting |

| Decision making | Owner or management cannot make a decision based on the work. | Management can make judicious decisions based on the insights provided by an accountant |

| Purpose | The purpose is to record financial transactions and keep them in order. | The purpose is to interpret and analyze financial transactions. |

| Analysis | Required no analysis | Requires an analysis of financial information |

| Preparation of financial statements | Provisional financial statements might be prepared by bookkeepers, but not always | An accountant is primarily responsible for creating the final books of account or financial statements and reviewing provisional statements to advise the management. |

| Qualification | Bookkeepers need at least 1-2 years of practical experience and an associate degree | Accountants will need to have a bachelor degree with 3-4 years of experience. Certified Public Accountant (CPA) is the premium qualification for an accountant. |

Conclusion

Corporate bookkeeping services today are evolving, especially due to the advancements in technology. Web-based applications help bookkeeper make the most of their time and maintain accuracy in their work at the same time. However, the experience and knowledge that a bookkeeping service would bring cannot be replaced. As such, businesses would still need to hire the expertise of a bookkeeper and an accountant.

The fact remains that both these roles are essential to any business. They are intertwined and help create the financial cycle of a business. Without the contributions of a bookkeeper, an accountant would need to take over the administrative duties making is expensive for businesses, while without an accountant, the management would not be able to make financial decisions based on the raw data that general ledger offers.